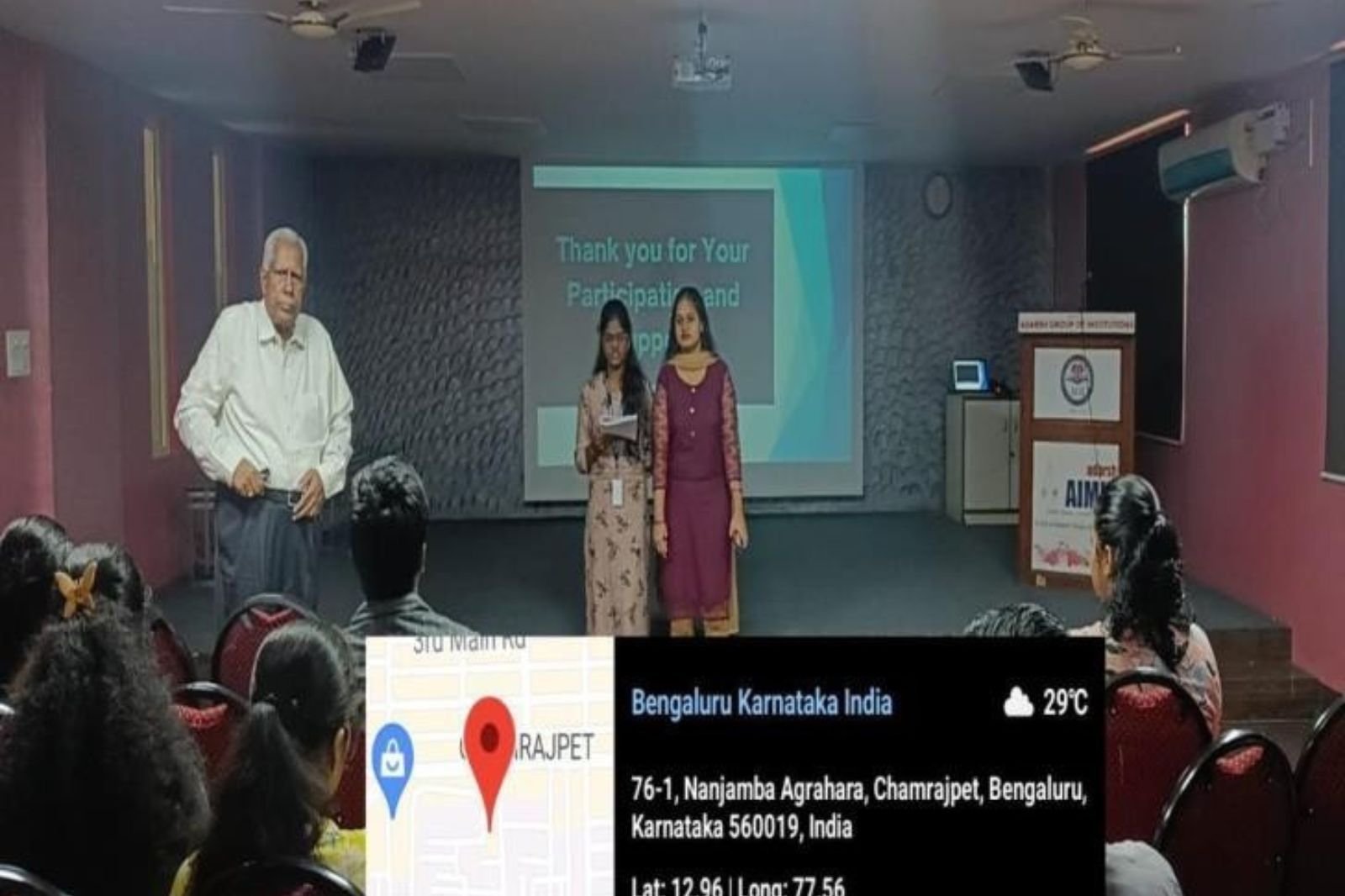

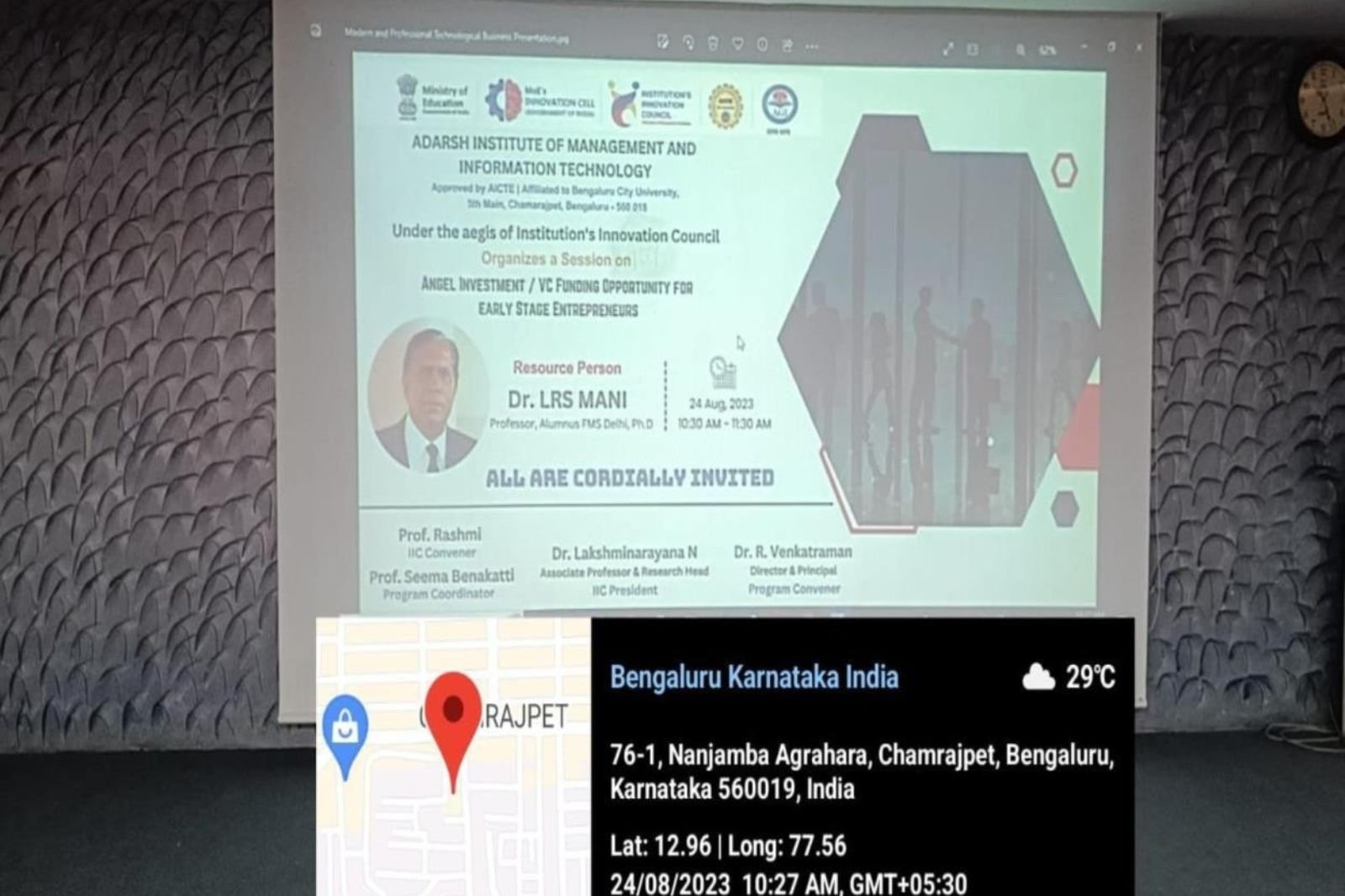

Angel Investment/ Vc Funding For Early-Stage Entrepreneurs

On August 24, 2023, from 10:30 AM to 11:30 PM, a seminar was held, attended by students from both section A and section D. The seminar primarily delved into the opportunities presented by angel investment and venture capital funding for early-stage entrepreneurs. Throughout the seminar, students gained a deep understanding of the core principles underlying Angel Venture and how it differs from Venture Capital. In the context of angel ventures, the primary aim is to nurture and support the growth of young individuals. In contrast to conventional investment approaches, venture capital firms do not directly deploy the funds they gather from various sources. Examples of venture capital include LIC and mutual funds. During the workshop, students gained insights into the differences between venture capital and angel investment, which stem from their unique characteristics and funding sources.

Investors consider various criteria when making investment decisions. A “elevator pitch” is a concise and compelling presentation of an idea or business that can be delivered in a short amount of time, typically the duration of an elevator ride. Crowdfunding involves raising funds for a project or venture by collecting contributions from a large number of individuals, often facilitated through online platforms. The term “Angel” in the context of early-stage investing has an etymology that students might have explored. Venture financing encompasses multiple stages, representing the various phases involved in securing financial support for a new business endeavor. Students also learned about prominent Angel investors in India, such as Binny Bansal, who has affiliations with Flipkart. The session provided a wealth of knowledge, and a question and answer session at the end of the presentation addressed inquiries related to the discussed concepts.